Property Tax Rate La Mesa Ca . Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Find out how much the property tax rate is for each area of san diego including proposition 60 vs 90, due dates and fee schedules for paying your. Please note that we can only. Tax rate area (tra) cities. Tax rate by tax rate area search. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Search for your bill using parcel/bill number, mailing address or unsecured bill number. * if you do not know the tax rate. The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with the california government code sections 53601, 53607, and 53635. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. View your bill and add the.

from www.homeadvisor.com

View your bill and add the. Find out how much the property tax rate is for each area of san diego including proposition 60 vs 90, due dates and fee schedules for paying your. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Search for your bill using parcel/bill number, mailing address or unsecured bill number. Please note that we can only. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. * if you do not know the tax rate. Tax rate area (tra) cities. Tax rate by tax rate area search.

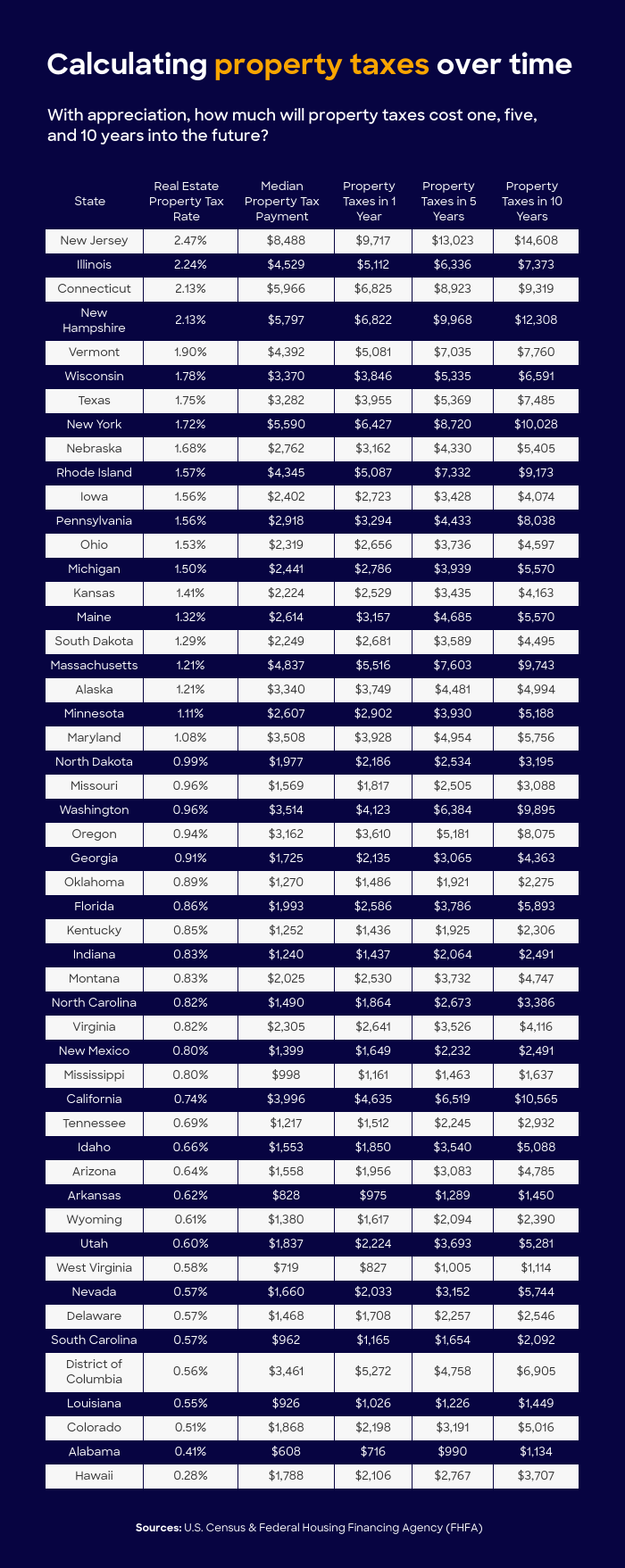

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor

Property Tax Rate La Mesa Ca The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with the california government code sections 53601, 53607, and 53635. * if you do not know the tax rate. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. View your bill and add the. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. Tax rate by tax rate area search. Find out how much the property tax rate is for each area of san diego including proposition 60 vs 90, due dates and fee schedules for paying your. Please note that we can only. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Tax rate area (tra) cities. Search for your bill using parcel/bill number, mailing address or unsecured bill number. The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with the california government code sections 53601, 53607, and 53635.

From time.news

Taxes why the property tax will increase so much in 2023 TIme News Property Tax Rate La Mesa Ca Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Search for your bill using parcel/bill number, mailing address or unsecured bill number.. Property Tax Rate La Mesa Ca.

From wyomingtruth.org

Wyoming Boasts Most Favorable Small Business Tax Rates in US The Property Tax Rate La Mesa Ca Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. Please note that we can only. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. The city treasurer’s primary responsibility is investing. Property Tax Rate La Mesa Ca.

From hattianabella.pages.dev

Tax Rates 2024 United States Cayla Daniele Property Tax Rate La Mesa Ca Please note that we can only. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: View your bill and add the. Tax rate by tax rate area search. To calculate the exact. Property Tax Rate La Mesa Ca.

From www.homeadvisor.com

Property Taxes By State Mapping Out Increases Over Time HomeAdvisor Property Tax Rate La Mesa Ca The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with the california government code sections 53601, 53607, and 53635. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Please note that we can only. Search for your bill using parcel/bill number, mailing address or unsecured bill number.. Property Tax Rate La Mesa Ca.

From www.zoocasa.com

Ontario Cities With the Highest and Lowest Property Tax Rates in 2022 Property Tax Rate La Mesa Ca Search for your bill using parcel/bill number, mailing address or unsecured bill number. Tax rate area (tra) cities. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with. Property Tax Rate La Mesa Ca.

From www.primecorporateservices.com

Comparing Property Tax Rates State By State Prime Corporate Services Property Tax Rate La Mesa Ca Please note that we can only. Search for your bill using parcel/bill number, mailing address or unsecured bill number. Tax rate area (tra) cities. Tax rate by tax rate area search. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. To calculate the exact amount of property tax. Property Tax Rate La Mesa Ca.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In Property Tax Rate La Mesa Ca * if you do not know the tax rate. The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with the california government code sections 53601, 53607, and 53635. Search for your bill using parcel/bill number, mailing address or unsecured bill number. Find out how much the property tax rate is for each area of. Property Tax Rate La Mesa Ca.

From www.momentumvirtualtours.com

Las Vegas Property Tax Momentum 360 2023 Taxes Property Tax Rate La Mesa Ca Tax rate by tax rate area search. Find out how much the property tax rate is for each area of san diego including proposition 60 vs 90, due dates and fee schedules for paying your. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's. Property Tax Rate La Mesa Ca.

From www.fox21online.com

Duluth's Council Approves 8.9 Increase In Property Tax Levy Property Tax Rate La Mesa Ca View your bill and add the. Please note that we can only. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. Tax rate area (tra) cities. Search for your bill using parcel/bill number, mailing address or unsecured bill number. Property valuations, tax rates useful information for taxpayers which. Property Tax Rate La Mesa Ca.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax Property Tax Rate La Mesa Ca Search for your bill using parcel/bill number, mailing address or unsecured bill number. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Tax rate area (tra) cities.. Property Tax Rate La Mesa Ca.

From azmemory.azlibrary.gov

Average statewide property tax rates 2008 Arizona Memory Project Property Tax Rate La Mesa Ca View your bill and add the. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Tax rate area (tra) cities. The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with the california government code sections 53601, 53607, and 53635. Find out how much the property tax rate. Property Tax Rate La Mesa Ca.

From kathleenshillxo.blob.core.windows.net

Property Taxes For Winchester Ca Property Tax Rate La Mesa Ca Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Search for your bill using parcel/bill number, mailing address or unsecured bill number. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. Tax rate by tax rate area search. The city treasurer’s. Property Tax Rate La Mesa Ca.

From greatsenioryears.com

States With No Property Tax for Seniors Greatsenioryears Property Tax Rate La Mesa Ca Search for your bill using parcel/bill number, mailing address or unsecured bill number. View your bill and add the. Find out how much the property tax rate is for each area of san diego including proposition 60 vs 90, due dates and fee schedules for paying your. Press calculate to see the average property tax rate, along with an estimate. Property Tax Rate La Mesa Ca.

From www.housingwire.com

Property taxes on singlefamily homes increase 6 in 2017 HousingWire Property Tax Rate La Mesa Ca Please note that we can only. Find out how much the property tax rate is for each area of san diego including proposition 60 vs 90, due dates and fee schedules for paying your. Search for your bill using parcel/bill number, mailing address or unsecured bill number. * if you do not know the tax rate. To calculate the exact. Property Tax Rate La Mesa Ca.

From issuu.com

PROPERTY TAX CALCULATOR by Cutmytaxes Issuu Property Tax Rate La Mesa Ca View your bill and add the. To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only. Tax rate area (tra) cities. Tax rate by tax rate area search. Property valuations, tax rates useful information for taxpayers which fiscal. Property Tax Rate La Mesa Ca.

From www.iras.gov.sg

2024 Property Tax Bill Property Tax Rate La Mesa Ca * if you do not know the tax rate. View your bill and add the. Tax rate by tax rate area search. Press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: Tax. Property Tax Rate La Mesa Ca.

From www.bluelinepm.com

A Landlord's Guide to the California Property Tax Rate Property Tax Rate La Mesa Ca Search for your bill using parcel/bill number, mailing address or unsecured bill number. Please note that we can only. Property valuations, tax rates useful information for taxpayers which fiscal year do you wish to view: View your bill and add the. Tax rate by tax rate area search. Press calculate to see the average property tax rate, along with an. Property Tax Rate La Mesa Ca.

From madonnawgrete.pages.dev

How Much Is Property Tax In California 2024 Shel Carolyn Property Tax Rate La Mesa Ca Please note that we can only. Tax rate area (tra) cities. The city treasurer’s primary responsibility is investing surplus funds in the city treasury in accordance with the california government code sections 53601, 53607, and 53635. Search for your bill using parcel/bill number, mailing address or unsecured bill number. Press calculate to see the average property tax rate, along with. Property Tax Rate La Mesa Ca.